Whatever the banks or financial advisors tell you regarding accumulating debts, consumer debt has never been your friend.

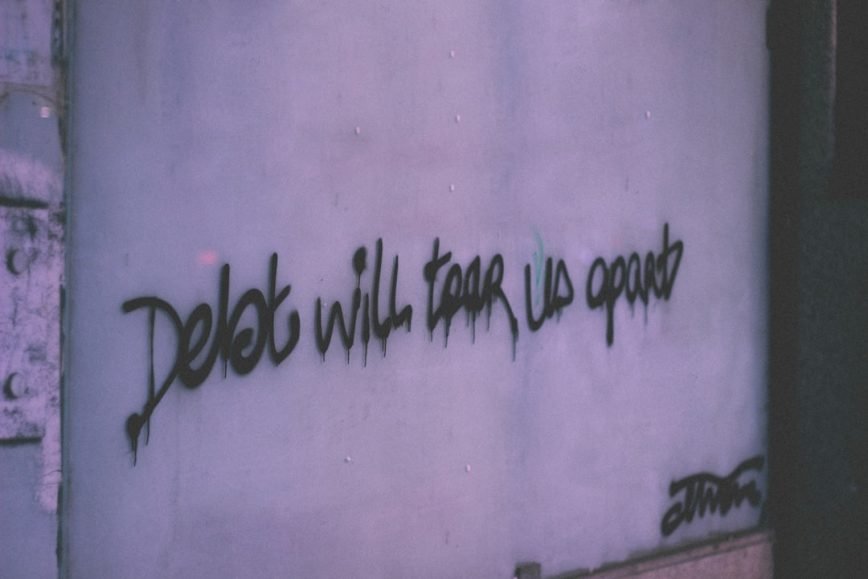

I would go as far as saying that personal debt is your mortal enemy that threatens to suck the happiness out of your life.

In our culture of instant gratification, it’s easy to overspend and indulge in excessive spending on unnecessary goods. If we stick to buying what we only need, the earth would be less polluted, our bank accounts would be much healthier, and our stress levels wouldn’t go over the roof the moment an unexpected expense happens.

If you have no cash to indulge in vanity spending, store cards, credit cards, or personal loans (I know people who took personal loans to send their kids to private school!!!), come to the rescue and are as easily accessible as online shopping. It’s easy to buy on credit; all you need is to sign on the dotted line, and all that you cannot afford may become yours to treasure.

However, as with everything in life, sooner or later, you will have to pay all that borrowed money back, and if you only pay the monthly minimum on your credit cards or your loans, it will take you a long time to pay the banks back.

Not having monthly credit card or personal loan payments coming out of your account gives you an incredible feeling of empowerment and opens doors and possibilities that life should be full of.

However, if every month a large portion of your earnings goes towards settling your debts, your spending power not only diminishes over time, but your saving power also evaporates before your eyes. The ratio of your savings and investments depends on how fast you want to be able to retire, move on to jobs that you truly love doing, travel the world, or move to a country you have always dreamed of living in.

Ever since I became an adult, “good friends”, banks and financial advisors have tried to convince me that good debt (the ones you pay back regularly) is good for my credit score. I cannot argue with that. And I won’t. But what if your spending isn’t within the limits of what you can afford? What if each month you rely on credit cards to pay for your living expenses because your daily living costs are so high? What if you lose your income and the government assistance (if you are lucky enough to receive any) you receive goes straight toward paying off your debts, leaving you with almost nothing to live on?

Of course, none of us ever thinks or believes that this bleak scenario could ever happen to us. Unfortunately, the current pandemic has shown that anything is possible, and the so-called “good debt” can be nothing more than a massive stone dragging individuals, families, and countries down.

I hear and read stories from people with pre-COVID comfortable lifestyles, holidays, cars and middle-class spending habits, who find themselves in line at a food bank every week because they have no savings to fall back on, nor investments to carry them through hard times. Instead, they have lots of flashy gadgets, cars on credit and store cards to pay off. In not-so-rare cases, when people lose their jobs, have none or very limited savings and cannot find any work for an extended period, paying back the banks the money they don’t have creates a pressure hardly anyone is mentally equipped to deal with.

When the times are good and money is flowing, that’s when you should save, not stupidly spend. Any item you buy that you cannot pay for in cash at the time of purchase will have to be repaid at some point. When you have a steady and regular income, it isn’t a problem, but what if that income stops? As a responsible adult, you need to be prepared (something children should be taught at school) for the time when financial or personal difficulties arise. Unfortunately, easy access to “free money” doesn’t teach people how to save, but instead adds anxiety and misery to people’s lives.

However you look at debts, however many opinions and pieces of advice you listen to, the bottom line is that carrying personal debt is toxic and can destroy your relatives’ lives. Shop responsibly, buy only what you need; the social statute doesn’t depend on what car you drive or how many new outfits you wear over the summer (Instagram life isn’t real!!!).

Debt kills happiness, and happiness is what we all strive to achieve. Debt takes away the joy of living. Life is too short; don’t waste it on paying off your debts. If you struggle to control your debts or spending, I suggest seeking advice from the government, Citizens’ Advice, and charities that can help you understand your spending and create a plan to pay off your debts.

PS. I’m #MadeByDyslexia – expect big thinking & small typos.

Leave a Reply